How Do You Claim Gambling Winnings On Taxes

Reporting Gambling Profits and Loss on Your Taxes Gambling Losses Can Be Deducted on Schedule A. If you itemize your deductions, you can deduct your gambling losses for the year on Schedule A. However, you can only deduct your loss up to the amount you report as gambling winnings. Without knowing the states involved, the general rule is that some states will require you to claim the gambling winnings in the state where they were won. Most states tax all income earned in their state, regardless of your residency. In addition, your resident state will require you to report the winnings, but will offer a credit or deduction. You can win a lot of money gambling in the United States. Of course, that means you’re also subjected to a casino winnings tax. If you’ve made a trip to the U.S. And your gaming winnings are high enough or you win a prize and take the cash equivalent, the IRS will deduct 30% off of your winnings. Nobody wants Uncle Sam to withhold their.

- How Do You Report Gambling Winnings On Taxes

- How Do You Claim Gambling Winnings On Taxes Owed

- How Do You Claim Gambling Winnings On Taxes Tax

- How Do You Claim Gambling Winnings On Taxes Due

- How Do You Claim Gambling Winnings On Taxes Without

- Do You Claim Gambling Winnings On Your Taxes

Lottery and Gambling Winnings

Winning the Lottery or scoring on a sports wager can change your life in profound ways. Congratulations on your lucky break!

Just remember that your good fortune includes a responsibility to pay taxes and fees on those winnings.

Gambling Winnings:

In 2018, Governor Phil Murphy signed a law that authorized legal sports betting in New Jersey. The law (A4111) allows people, age 21 and over, to place sports bets over the internet or in person at New Jersey's casinos, racetracks, and former racetracks. Sports betting is now among the many forms of gambling winnings that are subject to the New Jersey Gross Income Tax, including legalized gambling (sports betting, casino, racetrack, etc.) and illegal gambling.

Lottery:

New Jersey Lottery winnings from prize amounts exceeding $10,000 became subject to the Gross Income Tax in January 2009.

Withholding Rate from Gambling Winnings

Withholding Rate from Gambling WinningsNew Jersey Income Tax is withheld at an amount equal to three percent (3%) of the payout for both New Jersey residents and nonresidents (N.J.S.A. 54A:5.1(g)).

Withholding Rate from Lottery Winnings

The rate is determined by the amount of the payout. If a prize is taxable (i.e., over $10,000), the entire amount of the payout is subject to withholding, not just the amount in excess of $10,000. The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows:

- 5% for Lottery payouts between $10,001 and $500,000;

- 8% for Lottery payouts over $500,000; and

- 8% for Lottery payouts over $10,000, if the claimant does not provide a valid Taxpayer Identification Number.

New Jersey Income Tax withholding is based on the total amount of the prize won. For example, if two people win a New Jersey Lottery prize of $14,000 and split the proceeds equally, $7,000 of income is taxable to each person and is subject to the 5% withholding rate. Both taxpayers would be subject to the 5% withholding because the total amount of the prize exceeded $10,000.

New Jersey Income Tax withholding is based on the total amount of the prize won. For example, if two people win a New Jersey Lottery prize of $14,000 and split the proceeds equally, $7,000 of income is taxable to each person and is subject to the 5% withholding rate. Both taxpayers would be subject to the 5% withholding because the total amount of the prize exceeded $10,000. Companies that obtain the right to Lottery payments from the winner and receive Lottery payments are also subject to New Jersey withholdings. Each company is required to file for a refund of the tax withheld, if applicable.

LotteryNew Jersey Lottery winnings from prize amounts exceeding $10,000 are taxable. The individual prize amount is the determining factor of taxability, not the total amount of Lottery winnings during the year.

- For example, if a person won the New Jersey Lottery twice in the same year, and the winning prize amounts were $5,000 and $6,000, these winnings would not be subject to New Jersey Gross Income Tax. However, if that person won the Lottery once and received a prize of $11,000, the winnings would be taxable.

- This standard for taxability applies to both residents and nonresidents.

- The New Jersey Lottery permits donating, splitting, and assigning Lottery proceeds to someone else or to a charity. If you choose to donate, split, or assign your Lottery winnings, in whole or in part, the value is taxable to the recipient in the same way as it is for federal income tax purposes.

Making Estimated Payments

If you will not have enough withholdings to cover your New Jersey Income Tax liability, you must make estimated payments to avoid interest and penalties. For more information on estimated payments, see GIT-8, Estimating Income Taxes.

Out-of-State Sales:

Out-of-state lottery winnings are taxable for New Jersey Gross Income Tax purposes regardless of the amount.

Gambling winnings from a New Jersey location are taxable to nonresidents. Gambling includes the activities of sports betting and placing bets at casinos and racetracks.

Calculating Taxable Income

You may use your gambling losses to offset gambling winnings from the same year as long as they do not exceed your total winnings. If your losses were greater than your winnings, you cannot report the negative figure on your New Jersey tax return. You must claim zero income for net gambling winnings. For more information, see TB-20(R), Gambling Winnings or Losses.

You may be required to substantiate gambling losses used to offset winnings reported on your New Jersey tax return. Evidence of losses can include your losing tickets, a daily log or journal of wins and losses, canceled checks, notes, etc. You are not required to provide a detailed rider of gambling winnings and losses with your New Jersey tax return. However, if you report gambling winnings (net of losses) on your New Jersey return, you must attach a supporting statement indicating your total winnings and losses.

How Do You Report Gambling Winnings On Taxes

Reporting Taxable Winnings

Include taxable New Jersey Lottery and gambling winnings in the category of “net gambling winnings” on your New Jersey Gross Income Tax return.

Most gamblers hope to win money when they visit a casino, but many fail to think about the taxes they would have to pay on their winnings. Meet George and Frank, two American friends who spend a weekend gambling at the Las Vegas Bellagio. George wins $200 playing video roulette. Frank wins $1500 on a quarter slot machine (Play here). Both men make some significant financial mistakes that could get them into trouble with the IRS.

Mistake # 1 - Frank Fails to Pay Taxes on His Winnings

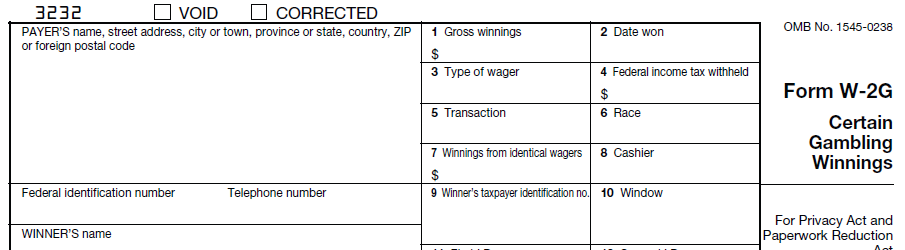

Before leaving the casino, Bellagio officials ask Frank to supply his Social Security number and fill out a W - 2G stating his $1500 winnings. When tax time rolls around, Frank forgets about the W – 2G and does not report the $1500 on his tax forms.

Could Frank Get in Trouble?

If Frank gets audited, he could indeed get in trouble with the IRS for failing to report his gambling income. Federal law mandates that slot machine winnings over $1200 must be reported to the IRS. The law also requires horse racing winnings over $600 and keno (click here) winnings over $1500 to be reported. Frank's legal obligation does not end with the W - 2G he filled out at the casino; he must also claim his winnings on Line 21 of his 1040. Failing to do this could result in stern penalties from the IRS.

What About George?

Bellagio officials did not ask George to fill out a W – 2G because his $200 earnings fell below the IRS threshold. Technically, however, he is supposed to claim his $200 winnings on Line 21 of his 1040 just like Frank. Unlike Frank, George stands little chance of getting caught if he fails to do this because there is no paper trail documenting his jackpot (read more). The only punishment George is likely to suffer is the discomfort of a guilty conscience.

If your winnings surpass the predetermined threshold, casino proprietors are required by law to have you fill out a W – 2G which reports your extra income. If you fail to submit this information to the IRS at tax time, government officials could catch a whiff of your paper trail and come after you. If your casino winnings do not surpass the predetermined threshold, you are still required by law to report the money, but without written evidence, the IRS stands little chance of catching you in your dishonesty.

Mistake # 2 - Frank Itemizes His $4000 Gambling Loss and Cheats Himself Out of the $5,950 Standard Deduction

Frank carefully records his losses at the Bellagio in a small notebook he keeps in his pocket. At the end of the weekend, he calculates a $4000 loss. When tax time rolls around, Frank itemizes this $4000 loss and feels like a tax-savvy gambling superstar. Unfortunately, the $4000 is Frank's only itemized deduction for the year and he's actually cheated himself out of a significant chunk of money. If Frank had bothered to do some research, he would have known that the standard deduction in 2012 is $5950. By itemizing only his $4000 loss at the Bellagio, Frank cheated himself out of an additional $1950 deduction.

The Moral of the Story

You can itemize gambling losses on your tax forms in order to recoup some of your lost money, but always find out what the standard deduction is first. You will only come out ahead if your itemized deductions add up to more than the standard deduction.

Mistake # 3 - George Itemizes His Gambling Losses, Which Are Greater Than His Winnings, and Gets in Trouble

After examining the pocketful of ATM receipts he accumulated while at the Bellagio, George realizes that although he won $200, he lost a total of $800. When tax time rolls around, George reports the $800 loss under the miscellaneous deductions section on Schedule A. He also reports his $200 winnings on Line 21 of his 1040. Unfortunately, George does not realize that deducted gambling losses cannot legally exceed gains. He gets audited and fined for failing to comply with this IRS regulation. It is perfectly acceptable to deduct your gambling losses, but you must also report your winnings. On top of that, your claimed losses may not exceed your stated winnings. George can legally claimed a $200 loss because he won $200, but he cannot legally claim an $800 loss in this scenario.

Mistake # 4 - George Fails to Document His Gambling Activities in an IRS-Approved Fashion

George is notified by the IRS that he is being audited and needs to provide legal documentation of the wins and losses he accumulated at the Bellagio. He digs through his suitcase, reassembles his collection of ATM and players card receipts, and submits these slips of paper to the IRS in a manila envelope. IRS officials reject his envelope, stating that this piecemeal form of documentation is unacceptable.

Conclusions

How Do You Claim Gambling Winnings On Taxes Owed

It is wise to track your casino expenditures, but saved receipts are not enough in the case of an IRS audit. Wins and losses should be logged in a notebook which includes the location, date, and amount of money won or lost. Game stubs are also acceptable documentation, but ATM and players club receipts are not.

How Do You Claim Gambling Winnings On Taxes Tax

All Americans must report gambling winnings to the IRS, regardless of what state or country they are in when they win. Gambling proprietors are required by law to report guest winnings that exceed certain predetermined amounts to the IRS. If you don't report your winnings and are audited, you could get in trouble.

Citizens are permitted to claim gambling losses on the miscellaneous deductions section in Schedule A, but losses may not exceed winnings. If you're thinking about itemizing gambling losses on your taxes, experiment with different deduction scenarios to see which will give you the biggest benefit.

Finally, keep track of your wins and losses in a detailed notebook. If you do get audited, IRS officials will only accept certain forms of financial documentation.

How Do You Claim Gambling Winnings On Taxes Due

What Else Might Interest You:

Online Roulette - Some basics for beginnersCOMMENTS:

By loading and joining the Disqus comments service below, you agree to their privacy policy.